A Buying Opportunity for Alternative Energy Mutual Funds and ETFs?

by Harris Roen Editor

Roen Financial Report

Tuesday, April 12, 2016

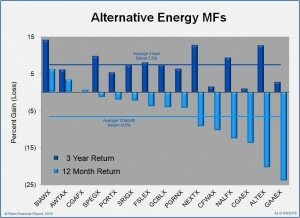

Alternative Energy Mutual Funds Trade Down for the Year

Alternative energy mutual funds have taken a hit, down 6.5% on average over the past 12 months. Just three of the 15 mutual funds we track are up for the year. The largest gainer, Brown Advisory Sustainable Growth Inv (BIAWX), is only up an anemic 6.2%.

Alternative energy mutual funds have taken a hit, down 6.5% on average over the past 12 months. Just three of the 15 mutual funds we track are up for the year. The largest gainer, Brown Advisory Sustainable Growth Inv (BIAWX), is only up an anemic 6.2%.

Much of the difficulty is due to a drop in solar stocks over the past 12 months. For example, if you look at the top weighted holdings of Guinness Atkinson Alternative Energy (GAAEX), nine out of 15 are solar stocks. All of those solar stocks are down for the year, off an average of 22%.

The April 2016 edition of Alternative Energy Mutual Funds & Exchange Traded Funds report is now available. Visit our Mutual Fund/ETF site to download your copy.

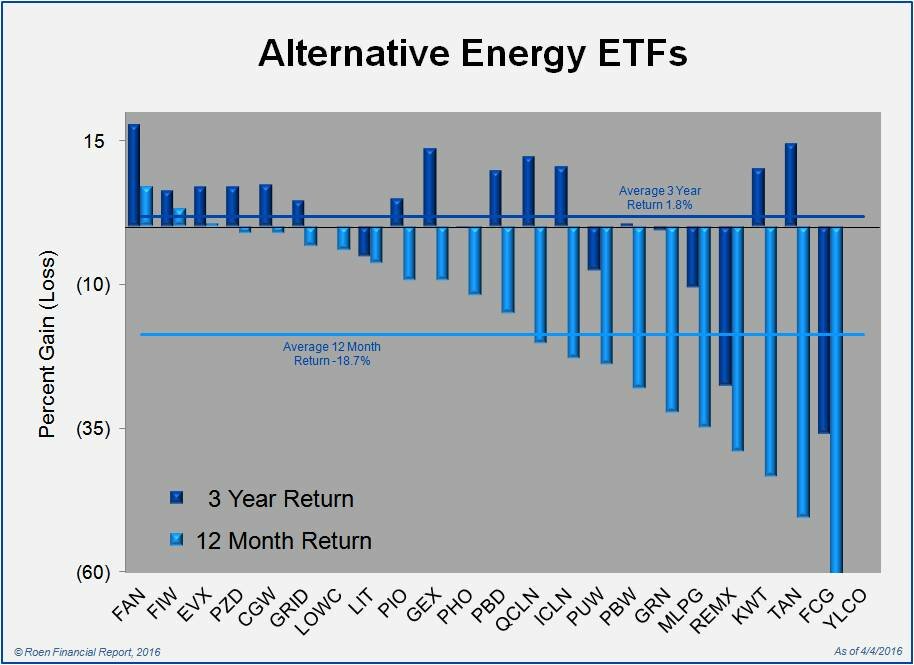

ETFs are Widely Lower

ETFs are Widely Lower

Alternative energy ETFs have suffered what can only be called stunning declines in the past 12 months. Of the 22 ETFs that we track (that have been trading more than a year), 19 are trending down. Two of the bottom three performers are solar ETFs. Alternative energy ETFs have fared better in the past quarter, with slightly more than half of ETFs trading in positive territory…

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.