Alternative Energy Portfolio Gives Back Gains

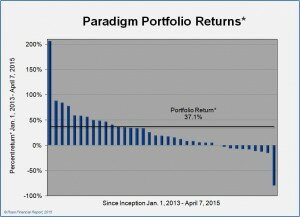

The Roen Financial Report Paradigm Portfolio has given back some of its gains, down 9% from the high reached a year ago. Still, this select portfolio has gained 37.1% since inception after accounting for additions, removals, and rebalancing*. This update includes one promising fuel alternative company that has been added to the portfolio, and one utility that is being removed.

Alternative Energy Stock Portfolio Returns

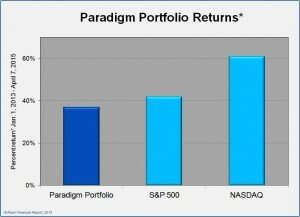

The Paradigm Portfolio is slightly down since the beginning of the year, having dropped 1.4% year-to-date. Since inception, the portfolio is now up 37.1%, an annualized rate of return of 15.0%. These gains are slightly below the S&P 500 index, but significantly lag the NASDAQ.

The Paradigm Portfolio is slightly down since the beginning of the year, having dropped 1.4% year-to-date. Since inception, the portfolio is now up 37.1%, an annualized rate of return of 15.0%. These gains are slightly below the S&P 500 index, but significantly lag the NASDAQ.

By far the best performing stock remains solar installer SolarCity (SCTY), up a spectacular 225% after rebalancing. Solar City was priced at $12.98/share when it entered the portfolio at the beginning of 2013, and is now trading above $50/share.

The poorest performing stock is the wind turbine and tower equipment company Broadwind Energy (BWEN), down a disappointing 79.9%. Considering these losses I wish I could have had a V-8, but recent positive news on new wind turbine orders could cause a turnaround in its stock price.

The poorest performing stock is the wind turbine and tower equipment company Broadwind Energy (BWEN), down a disappointing 79.9%. Considering these losses I wish I could have had a V-8, but recent positive news on new wind turbine orders could cause a turnaround in its stock price.

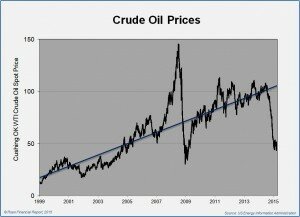

Looking at the wider picture, a large part of the reason for the underperformance of alternative energy companies is the drop in fossil fuel prices that started about a year ago. As oil prices dropped, investors assessed that renewables would find it more difficult to be price competitive with conventional fuels.

The stock market generally projects out six months to a year, so conventional wisdom was that oil prices would remain down. I continue to believe that a low oil price is the most likely scenario in the short to medium term. Having said that, I have no doubt that long term trend for oil prices will continue to be up. For that reason and others, I am still bullish on alternative energy stocks.

Fuel Efficiency Company Added

Cummins Inc (CMI) is a large global engine manufacturer based in Indiana. An important part of its business is the design, manufacture and service of energy efficient next-generation diesel engines and low emission natural gas engines.

Transportation contributes more than a quarter of greenhouse gas emissions in the U.S., and studies have shown that increasing fuel efficiency is critical to reducing global warming. As a result, the low pollution diesel and natural gas fleet engines that companies like Cummins manufacturer are an important part of addressing this problem. We are adding this profitable company to the portfolio now because it has low debt, solid earnings, a generous 2.3% yield. In our estimation, CMI is fairly priced in its current trading range in the mid 130’s.

Utility Removed From Portfolio

Public Service Enterprise Group, Inc. (PEG), a large utility servicing the northeast and mid-Atlantic states, is being recommended for removal from the Paradigm Portfolio. We consider the stock to be overvalued at current levels, so believe it is a good time to realize the 33.6% gain that the company has achieved.

Additionally, we feel it is prudent for portfolios to lighten up on the utility sector. Conventional power utilities are coming under pressure as new economic and engineering paradigms are challenging their traditional utility business model and profit centers. As more renewables are coming on line, sources such as solar and wind create a whole new bundle of challenges for utilities, including intermittent supplies, feed-in tariffs, energy storage, microgrids, security and others. Unless utilities innovate and adapt to the inevitable future of electricity, it will cause difficulty in the sector down the road.

Alternative Energy Investment Prospects – Continued Upside Ahead?

Despite the gains that alternative energy stocks have given back in the past year, the near-term prospects for green investments may have improved. As the chart shows, the Wilder Hill New Energy Global Index (NEX) formed a third bottom in November. For technical traders, this kind of triple down cycle is often viewed as the turning point of a new trend. This, combined with the fact that the NEX has crossed its 200 day moving average, could point to sustained price increases. The index would have to remain above the moving average for several months, though, before we would be confident that this signals a significant move on the upside. Despite this uncertainty, we still believe that the long-term prospects of solar, wind, smart grid and other green investments look very promising for the long-term investor.

Despite the gains that alternative energy stocks have given back in the past year, the near-term prospects for green investments may have improved. As the chart shows, the Wilder Hill New Energy Global Index (NEX) formed a third bottom in November. For technical traders, this kind of triple down cycle is often viewed as the turning point of a new trend. This, combined with the fact that the NEX has crossed its 200 day moving average, could point to sustained price increases. The index would have to remain above the moving average for several months, though, before we would be confident that this signals a significant move on the upside. Despite this uncertainty, we still believe that the long-term prospects of solar, wind, smart grid and other green investments look very promising for the long-term investor.

*Hypothetical gain from portfolio recommendations. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on this list. For an explanation of how hypothetical returns are calculated, please see the Returns section under How Investments are Picked in the Roen Financial Report User Guide.

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.