A Buying Opportunity for Alternative Energy Mutual Funds and ETFs?

by Harris Roen Editor

Roen Financial Report

Tuesday, April 12, 2016

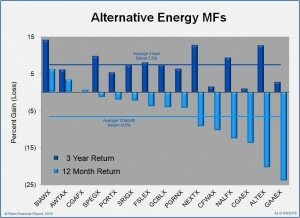

Alternative Energy Mutual Funds Trade Down for the Year

Alternative energy mutual funds have taken a hit, down 6.5% on average over the past 12 months. Just three of the 15 mutual funds we track are up for the year. The largest gainer, Brown Advisory Sustainable Growth Inv (BIAWX), is only up an anemic 6.2%.

Alternative energy mutual funds have taken a hit, down 6.5% on average over the past 12 months. Just three of the 15 mutual funds we track are up for the year. The largest gainer, Brown Advisory Sustainable Growth Inv (BIAWX), is only up an anemic 6.2%.

Much of the difficulty is due to a drop in solar stocks over the past 12 months. For example, if you look at the top weighted holdings of Guinness Atkinson Alternative Energy (GAAEX), nine out of 15 are solar stocks. All of those solar stocks are down for the year, off an average of 22%.

The April 2016 edition of Alternative Energy Mutual Funds & Exchange Traded Funds report is now available. Visit our Mutual Fund/ETF site to download your copy.

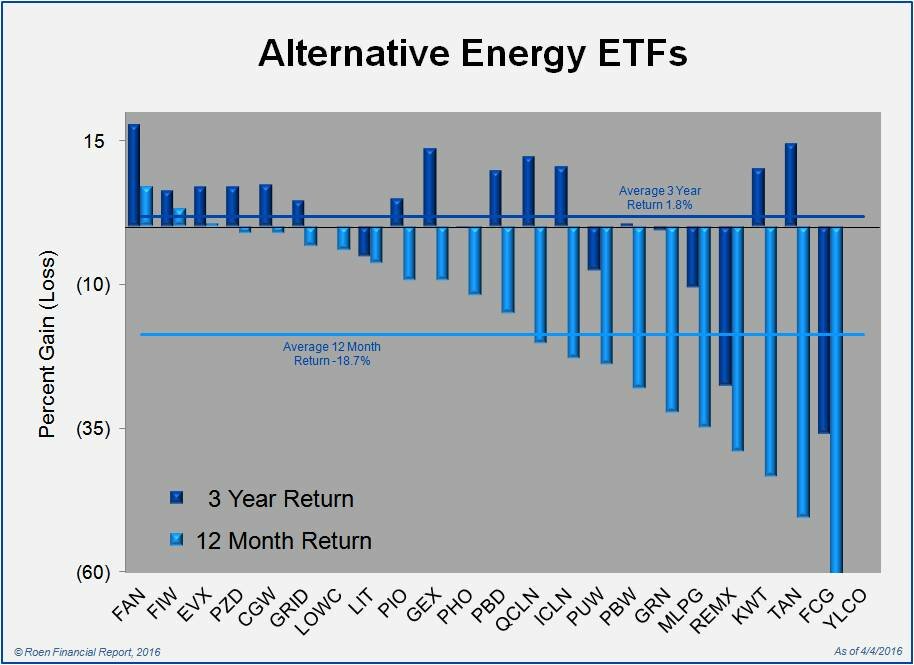

ETFs are Widely Lower

ETFs are Widely Lower

Alternative energy ETFs have suffered what can only be called stunning declines in the past 12 months. Of the 22 ETFs that we track (that have been trading more than a year), 19 are trending down. Two of the bottom three performers are solar ETFs. Alternative energy ETFs have fared better in the past quarter, with slightly more than half of ETFs trading in positive territory…

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: FSLR, SCTY, SPWR

by Harris Roen Editor

Roen Financial Report

Thursday, February 25, 2016

Today’s Alert:

First Solar, Inc (FSLR)

SolarCity Corp (SCTY)

SunPower Corp (SPWR)

Tremendous gains in solar stocks yesterday as investors buy at the bottom.

|

|

|

| First Solar stock surges 12% on large volume after releasing a positive earnings report. Annual earnings came in at $5.37 per share, which was at the high end of analyst estimates. FSLR is now up 19% for the year, and is within 6% of its high reached in 2014. | The Street |

|

|

|

| SolarCity gains 5% on news of a shakeup in rival SunEdison (SUNE). This could increase business opportunities for SolarCity, including installation capacity and residential solar assets. SCTY remains down 64% for the year, and is 78% below its highs reached in 2014. | Motley Fool |

|

|

|

| SunPower Corporation jumps 11%, bouncing off a low last week. The technical chart shows a compressing saw-tooth trend, with lower highs, and higher lows going forward. SPWR is down 31% for the year, though we still consider the stock to be Overvalued. | Google finance |

DISCLOSURE

Individuals involved with the Roen Financial Report and Swiftwood Press LLC owned or controlled shares of SUNE, SCTY. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: SSNI

by Harris Roen Editor

Roen Financial Report

Wednesday, February 10, 2016

Today’s Alert:

Silver Spring Networks Inc (SSNI)

Robust earnings and a newly minted partnership with Con Ed gives this smart grid stock a big boost.

|

|

|

| Smart grid company Silver Spring Networks surges up 14% on a preliminary earnings report release. Expected earnings per share beat analyst estimates, and revenues are projected to be 6%-8% above the previous quarter. SSNI stock is up 31% for the year, and is 61% above its lows of 2014. | Press release |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: ABB

by Harris Roen Editor

Roen Financial Report

Wednesday, February 3, 2016

Today’s Alert:

Is this a buying opportunity for this large Swiss-based smart grid stock?

|

|

|

| Power grid supplier ABB falls 3% on a lackluster earnings report. Softening of demand in China led to an 11% decrease in revenues compared to the same quarter last year, and a 70% drop in net income. ABB stock is down 14% for the year and is approaching its 2012 lows. We consider the stock to be Undervalued. | Press release |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: ENOC

by Harris Roen Editor

Roen Financial Report

Wednesday, January 27, 2016

Today’s Alert:

A Supreme Court ruling affirms the business model of this smart grid company, delighting investors.

|

|

|

| Demand response company EnerNOC is up 44% in two days on a beneficial U.S. Supreme Court ruling. The ruling allows consumers to receive better utility rates if they alter their usage to off-peak times. This volatile stock is up 81% since the beginning of January, but remains 75% below its highs reached in 2014. | Press release |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.