Stock Alert: AYI

by Harris Roen Editor

Roen Financial Report

Tuesday, January 12, 2016

Today’s Alert:

A pullback in this LED lighting stock after a strong earnings report suggests that it may have gotten ahead of itself.

|

|

|

| Lighting efficiency company Acuity Brands drops 8% in two days on large volume, despite an upbeat earnings report. Earnings and revenues came in above analyst estimates, and net income is 34% higher than the same quarter last year. AYI stock is still up 36% for the year. | SEC filing |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

2015 a Mixed Year for Alternative Energy MFs and ETFs

by Harris Roen Editor

Roen Financial Report

Tuesday, January 5, 2016

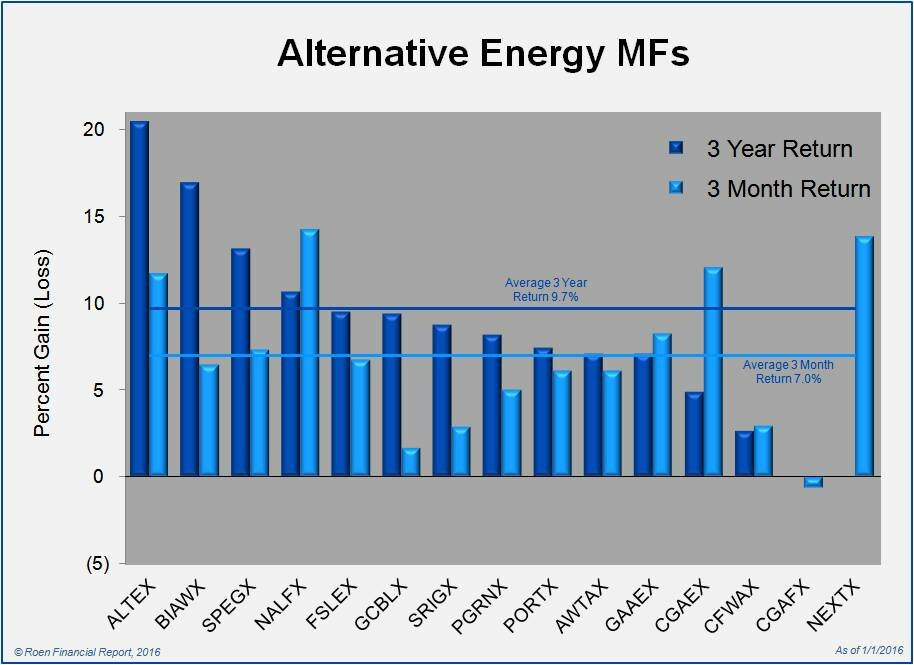

Alternative Energy Mutual Funds Trade Flat for the Year

Alternative Energy Mutual Funds Trade Flat for the Year

Alternative energy mutual funds followed the overall stock market this year, closing about flat on average for 2015. The story gets more interesting, though, when you look at gains in the last quarter. Sectors such as solar and wind took a big hit by September, but then rebounded handsomely before years end. Green MFs were up 7% on average for the past three months, with 14 out of the 15 funds trading in the black…

The January 2016 edition of Alternative Energy Mutual Funds & Exchange Traded Funds report is now available. Visit our Mutual Fund/ETF site to download your copy.

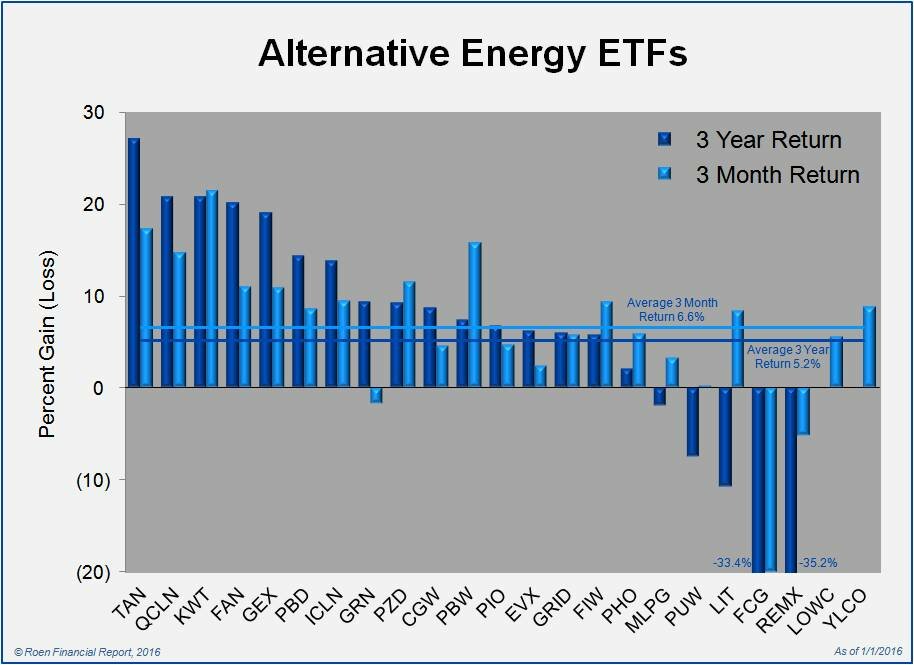

ETFs are Widely Lower

ETFs are Widely Lower

2015 was a year of financial ups and downs, and alternative energy exchange traded funds were no exception. Returns of green ETFs varied widely but took a hit on average, losing 10.1% for the year. About three-quarters of ETFs showed losses in 2015, with some funds trading down heavily.

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: FCEL, TSLA

by Harris Roen Editor

Roen Financial Report

Tuesday, January 5, 2016

Today’s Alert:

FuelCell Energy, Inc (FCEL)

Tesla Motors Inc (TSLA)

A chilling first trading day of the year had alternative energy stock losers outpace gainers by a 3:1 margin. One of these fuel alternative stocks had impressive short-term gains, while one took a heavy loss.

|

|

|

| FuelCell Energy jumps 13% on heavy trading. Investors pile in on news of a 5.6-megawatt power plant deal with Pfizer. This stock price lift is coming off an all-time low, and FCEL is still down 70% in the past 12 months. | The Street |

|

|

|

| Tesla Motors tumbled 7% despite record vehicle deliveries. The number of electric cars sold was 50% higher than the previous quarter, but still came in on the low end of expected guidance. TSLA stock is trading flat for the year, and is down 22% from its highs reached in September 2014. | Nasdaq |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: SUNE

by Harris Roen Editor

Roen Financial Report

Tuesday, December 22, 2015

Today’s Alert:

Bad news for this vertically integrated solar photovoltaic company.

|

|

|

| SunEdison nosedives 29% on news of a class action suit that alleges the solar company made misleading statements about its business prospects. SUNE stock is trading flat for the week but remains down 73% for the year. | Business Wire |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: FSLR, PEGI, SCTY

by Harris Roen, Editor

Roen Financial Report

Thursday, December 17, 2015

Today’s Alert:

First Solar, Inc (FSLR)

Pattern Energy Group Inc (PEGI)

SolarCity Corp (SCTY)

It was a banner day for alternative energy stocks yesterday, due to extension of the investment tax credit and other factors.

|

|

|

| First Solar pops up 10%, getting a lift from news of renewal of the Investment Tax Credit (ITC). FSLR stock is at an annual high, up 55% in the past 12 months. | Motley Fool |

|

|

|

| The YieldCo Pattern Energy Group gaps up 12% on the largest volume since the summer. Recent analysis considers it by far the best valued YieldCo. PEGI is still down 12% for the year, but has gained 26% from its lows reached earlier in December. | AltEnergy Stocks |

|

|

|

| Solar City skyrockets 34% in one day. The stock benefited from many factors, including newly released analysis from the company, extension of Investment Tax Credit (ITC), analyst upgrades, and a severe short squeeze. SCTY stock is now in positive territory for the year, but is still 38% below its 2014 highs. | Seeking Alpha |

DISCLOSURE

Individuals involved with the Roen Financial Report and Swiftwood Press LLC owned or controlled shares of SCTY. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.