Stock Alert: CPST, FCEL, HQCL

by Harris Roen Editor

Roen Financial Report

Monday, December 7, 2015

Today’s Alert:

Capstone Turbine Corp (CPST)

FuelCell Energy, Inc (FCEL)

Hanwha Q Cells (HQCL)

Reverse stock splits spell doom for two fuel alternative stocks, but benefit an Asian solar stock.

|

|

|

| Capstone Turbine is anguishing from an 80% loss in the past three months, suffering from a reverse stock split executed in November. A pre-release of second quarter earnings were particularly dismal. CPST stock is down fully 97% for the year to an all-time low. | Seeking Alpha |

|

|

|

| Integrated base-load fuel cell company FuelCell Energy initiates a 1:12 reverse stock split. FCEL stock drops 18% in one day, and is down 83% from its highs reached in March 2014. | Nasdaq Globe Newswire |

|

|

|

| Solar module manufacturer Hanwha Q Cells trades up 6% in two days, and shares are up 20% since its 1:10 ADR reverse stock split. Investors see Hanwha Q Cells as a solid momentum play with favorable earnings estimates. HQCL stock is up 136% from its low in August. | Zacks |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: ITC, PEIX, REGI

by Harris Roen Editor

Roen Financial Report

Tuesday, December 1, 2015

Today’s Alert:

ITC Holding Corps (ITC)

Pacific Ethanol Inc (PEIX)

Renewable Energy Group Inc (REGI)

Rumors of a company sale boost an electric transmission stock, and encouraging EPA decision helps two biodiesel companies.

|

|

|

| Paradigm Portfolio stock ITC Holdings Corp jumps 9% on historic volume after news leaks of potential company sale. Target purchase price could be as much as $45/share, 22% above its current stock price. We consider the stock to be Undervalued. | Bloomberg Business |

|

|

|

| An EPA decision to increase biomass-based diesel volume targets causes Pacific Ethanol trades up 21% on the largest volume since May. A recent insider buy and a bottoming chart pattern could mean more upside from here. This speculative stock is still down 58% for the year. | Wall Street Point |

|

|

|

| Biodiesel company Renewable Energy Group gains 7% on an EPA decision to increase biomass-based diesel volume targets. This final EPA rule projects biodiesel production to grow 16% in two years. A pure-play Paradigm Portfolio stock, REGI is trading flat for the year but has almost doubled from its lows of 2012. | Business Wire |

NO OWNERSHIP

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Alternative Energy Portfolio and the New Energy Economy

by Harris Roen, Editor

Roen Financial Report

November 20, 2015

The Roen Financial Report Paradigm Portfolio is a hand-picked group of alternative energy stocks considered to be top choices in the sector for long-term investments. These companies are positioned to benefit from the clean energy paradigm shift that is a large and growing part of the global economy. This update includes two promising additions to the portfolio, the removal of a problematic penny stock, and thoughts on long-term prospects for the new energy economy.

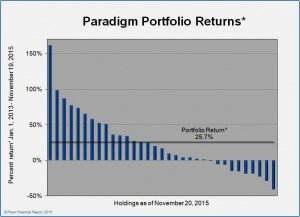

Alternative Energy Stock Portfolio Returns

The Paradigm Portfolio is up 25.7% from inception on January 2, 2013, after accounting for additions, removals, and rebalancing*. This is in spite of the portfolio being down 9.8% since the update a year ago in November 2014. Still, this is not as bad a drop as what occurred in the Wilder Hill New Energy Global (NEX), which is down 11.4% over the same time period.

The best performing stock in the Paradigm Portfolio remains solar developer SolarCity (SCTY), up 161.1% after rebalancing. SolarCity continues to be an excellent performer for the portfolio despite a recent price drop brought on by an ill-received earnings report in late October.

The poorest performing stock was the biofuel and food waste recycling company Darling Ingredients Inc (DAR), down 41.0%. Although sales have been solid for this company, earnings per share came in slightly negative in its most recent financial release, below the consensus analyst estimates.

Fuel Efficiency Company, Solar Play Added

Increased fuel efficiency is a critical enterprise in the new energy economy. About 27% of greenhouse gas emissions in the U.S. come from the transportation sector. Because of this, engine and drive train efficiency company BorgWarner, Inc (BWA) shows excellent promise as an addition to the Paradigm Portfolio. BorgWarner has robust sales, good cash flow, solid earnings, and we consider it to be undervalued at its current stock price.

The second addition to the Paradigm Portfolio is Corning Inc (GLW), a global supplier of silicon products used in photovoltaics, pollution control and other applications. We like Corning because the solar industry can be very volatile. This defensive industrial company has had positive earnings, consistent dividends, positive cash flow and relatively low debt for at least the past seven years. Solar is still a growth industry, and Corning has a proven track record of supplying silicon products to photovoltaic manufacturers. Corning will almost certainly be supplying solar materials well into the future regardless of other players that may come and go.

Micro Cap Wind Stock Removed From Portfolio

Wind turbine and tower company Broadwind Energy, Inc (BWEN) has taken a hit since entering the portfolio in April 2014. The stock price has suffered due to low return on assets, a depressed price-to-sales ratio, and continued negative earnings that have consistently come in below analyst estimates. It is deemed best to remove this volatile penny stock from the Paradigm Portfolio before its price declines further.

Sunshine or Clouds? Alternative Energy Investment Prospects

As my faithful readers know, I am bullish about viability of alternative energy as a long-term investment story. There is no doubt in my mind that the continued growth of solar installations is all but assured. For example, according to GlobalData, the total global installed capacity of photovoltaics increased 29% from 2013 to 2014, and is slated to increase another 27% to 223.2 gigawatts in 2015. Wind power development has slowed down for the moment, but there is a big push to develop large-scale offshore wind in North America and abroad. And infrastructure needed to transform the energy landscape, such as smart grid improvements, energy storage, and increased efficiency, are all developing at a rapid pace. Additionally, it is important to look at the broader economic drivers that affect this sector.

There was a time when most analysts, myself included, pegged the prospects of alternative energy to fossil fuel pieces. The thinking went that since developing wind, solar, etc., are an “alternative” to fossil fuel energy development, when oil and gas prices go down, less solar and wind will get built. There is some truth to this, especially since natural gas is the fuel of choice for base-load electric. Going forward, though, I believe overall economic growth will drive alternative energy development more so than the price of fossil fuels. Part of the reason for this is that oil prices had become a proxy for how speculators thought the economy would perform, and that connection has started to decouple.

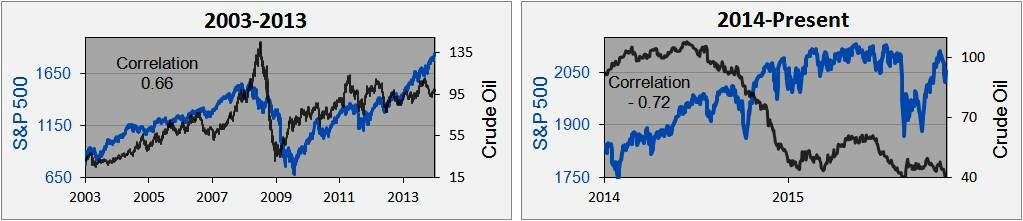

The charts above show crude oil prices broken down into two time periods, from 2003-2013, and 2014 to the present. The price of oil is graphed against the S&P 500 stock market index. The stock market is a forward-looking economic indicator, so is a good overall measure of the economy.

The left chart shows a clear correlation between the price of oil, and the S&P 500. A 1.00 correlation factor would be a perfect congruence, but a 0.66 correlation is significant. This is the epoch that investors started buying oil futures not because they were interested in crude supplies, but because they thought as the economy improved, more oil would be consumed, which would increase demand and lift oil prices.

This investment trend started to fall apart in mid 2013, and continues to diverge. This can be seen in their strong negative correlation factor of -0.72. The most likely trend going forward is that the economy will continue to expand and retract regardless of the direction of fossil fuel prices.

It is true that as the economy grows, the need for energy will grow with it. Because of this, the push for clean energy will likely remain strong. This thrust for expanding renewable energy investment is seen through efforts like the United Nations Paris Climate Talks, concerns about energy security, and increasing economic viability of renewables. This push away from fossil fuels will only benefit sectors such as solar, wind, smart grid and other green investments.

*Hypothetical gain from portfolio recommendations. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on this list. For an explanation of how hypothetical returns are calculated, please see the Returns section under How Investments are Picked in the Roen Financial Report User Guide.

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC owned or controlled shares of SCTY. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: JASO, SOL, VSLR

by Harris Roen Editor

Roen Financial Report

Wednesday, November 18, 2015

Today’s Alert:

JA Solar Holdings Co, Ltd (JASO)

ReneSola Ltd (ADR) (SOL)

Vivint Solar Inc (VSLR)

One American solar developer and two Chinese solar manufactures react to earnings reports.

|

|

|

| Third quarter earnings results cause JA Solar stock to drop slightly, despite a surge in revenues and profits. Net income is up 60% year-over-year, and revenues have increased 26%. Solar cell and module shipments are up over 40% for the quarter and from the previous year. JASO stock is up 24% in the past three months, but is trading flat for the year. | Press release |

|

|

|

| Chinese solar company ReneSola trades down slightly on a mixed earnings report. Revenues are up 37% for the quarter, but are flat year-over-year. Net income turns positive. This volatile penny stock is down 39% for the year, but is up 43% since its lows in September. | Press release |

|

|

|

| Solar installer and distributor Vivint Solar tumbles 23% to an all-time low. Its earnings release shows revenues have almost tripled compared to the same quarter last year, but net losses remain flat. VSLR stock is off 54% from its IPO high in 2014. | SEC filing |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

Stock Alert: SUNE, TERP

by Harris Roen Editor

Roen Financial Report

Wednesday, November 11, 2015

Today’s Alert:

SunEdison Inc (SUNE)

TerraForm Power Inc (TERP)

A solar developer and its related YieldCo take a big hit after releasing earnings.

|

|

|

| SunEdison plummets -22% on historically high volume. Revenues were flat and net losses expanded slightly, but debt grew 67% in a year to $11.7 billion. SUNE stock is now down -68% for in 12 months, trading back at 2013 levels. | SEC filing |

|

|

|

| SunEdison’s YieldCo TerraForm Power falls -21% on a mixed earnings report. Analyst concerns include a lack of guidance and a decline in the project pipeline. TERP is down -47% for the year, and is trading near is all-time low. | Seeking Alpha |

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.