Is This the Right Time for YieldCo’s?

by Harris Roen, Editor

Roen Financial Report

October 27, 2015

Yield investing remains a popular strategy in the alternative energy investment universe, especially in today’s low interest rate environment. One popular investment, YieldCo’s, achieved spectacular gains last spring, but have since entered some rocky terrain. This Green Dividend Yield Portfolio update considers alternative energy yield investments, analyzes the plight of YieldCo’s, and looks to future trends in yield investing.

Green Dividend Yield Portfolio Expands

The Roen Financial Report Green Dividend Yield Portfolio is made up of high-yielding alternative energy companies and YieldCo’s aimed at generating meaningful income for dividend investors. This diversified stock portfolio is carefully picked from a universe of +/- 250 alternative energy companies to include those that fall in the yield “sweet spot”—high enough to be attractive, but not so high as to raise a red flag.

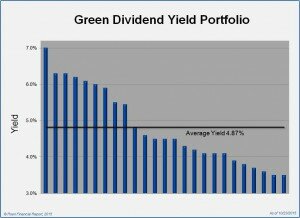

The Green Dividend Yield Portfolio has expanded to 24 companies, with yields ranging from 3.5% to 7.0%. This wider pool of dividend producing alternative energy companies is partially attributed to the drop in stock prices that has occurred over the past six months. When a stock price drops and the dividend stays the same, then yield increases.

Considering this, it is important to look at the quality of the yield as well as the rate. If a company has strong financial metrics in important areas like return on equity, cash flow and dividend growth, it is much more likely to provide healthy dividends into the future. For that reason, companies in the Green Dividend Yield Portfolio are categorized into three dividend quality classes: high quality, medium quality and low quality. The better the dividend quality, the better the prospects of a company’s ability to pay out steady dividends, or even increasing dividends, into the future. In addition, stocks in the Green Dividend Yield Portfolio are ranked on a scale from 1 to 5, with 1 being the highest quality yield producing stocks relative to other companies in the portfolio.

Should Green Dividend Yield Investors Buy YieldCo’s?

Four new YieldCo’s have been added to the Green Dividend Yield Portfolio. This merits a discussion on this relatively new green security in order to determine if this is an investment whose time has come, or if the risk is just too great.

YieldCo’s are companies that own the cash flow from a renewable energy project. The business model, then, is to pay out most of the cash flow as dividends, and to continually buy new renewable energy projects in order to grow dividends. This also benefits project developers by generating income from the sale of solar, wind, efficiency or hydro projects, which frees them to develop more. For example, the newly minted YieldCo 8Point3 Energy Partners LP (CAFD) is a partnership formed by First Solar and SunPower to buy solar projects that the two companies develop.

The reason YieldCo’s were created was to essentially create better financing options for renewable energy project developers. YieldCo’s capitalize on the fact that once built, most solar and wind generating facilities are high quality, low-risk, income producing assets. Fossil fuel companies already enjoy low-risk financing through REITs and Master Limited Partnerships, options that are not yet available to renewable energy or efficiency projects.

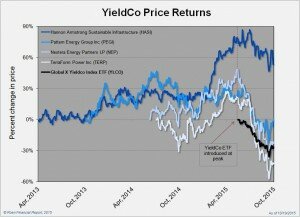

YieldCo’s are generally designed for dividend growth, not necessarily stock price appreciation. However, their popularity early on caused investors to pile in, creating some fantastic price growth. The chart below graphs two YieldCo’s that have been around for over two years, HASI and PEGI, and two that were introduced about a year ago, NEP and TERP.

By the spring of 2015, the stock price of these YieldCo’s gained handsomely, between 30% and 90%. Several YieldCo IPO’s were rolled out at this time as well, including TerraForm Global Inc (GLBL) and 8Point3 Energy Partners LP (CAFD), which had the effect of saturating the asset class. Also at that time the exchange traded fund Global X YieldCo Index ETF (YLCO) started trading, garnering more attention to a sector that already had a lot of eyes on it. As I warned at the time, waiting for YieldCo prices to drop was deemed a prudent course of action, considering the excessive gains they had just booked. Since last spring there has been a bursting of a bubble of sorts, with YLCO falling 36% in less than four months.

So is this a good time to invest in YieldCo’s? Though prices have begun to normalize, P/E’s are still high for YieldCo’s, averaging out in the upper 60’s. I would like to see YieldCo stock prices fall 10% to 20% from current levels before they become more attractive.

Also, many of the YieldCo’s are based on a model of dividend growth, which in my view had much to do with their inflated stock prices. Investors began to realize the project acquisition rates needed to sustain such growth was a dubious proposition. If they pivot their business model to one of continuous, high-quality yield instead of yield growth, YieldCo’s should remain viable investments.

For a more detailed analysis I recommend listening to this Interchange Podcast sponsored by Greentech Media. In it, alternative energy investor and analyst Tom Konrad explains some of the intricacies surrounding YieldCo’s, and also offers a bullish assessment despite this recently depressed market.

Removals

ABB Ltd (ABB), the large automated power company involved in key smart grid areas, is being removed from the dividend yield portfolio. Its yield has dropped below 3.5%, so is out of the range for this portfolio. On the other end of the yield spectrum, the large German utility RWE AG (ADR) (RWEOY) has been removed from the portfolio because its yield exceeds 7%, making it too risky a proposition.

Conclusion

Since we live in a time when interest rates are about as low as they are going to get, it can be challenging to find descent, stable yield. A diversified basket of dividend stocks, if bought at the right price, can be a successful way to add income to a portfolio. To find a complete list of the Roen Financial Report Green Dividend Yield Portfolio companies and rankings, please visit http://roenreport.com/premium/green-dividend-yield-portfolio/.

IMPORTANT INFORMATION

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article. It is also possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.